The 6-Minute Rule for Clark Wealth Partners

About Clark Wealth Partners

Table of ContentsSome Known Facts About Clark Wealth Partners.Indicators on Clark Wealth Partners You Should KnowHow Clark Wealth Partners can Save You Time, Stress, and Money.Clark Wealth Partners Fundamentals ExplainedGetting The Clark Wealth Partners To Work

Just placed, Financial Advisors can tackle component of the duty of rowing the boat that is your economic future. A Financial Expert need to deal with you, except you. In doing so, they must work as a Fiduciary by placing the finest interests of their clients above their very own and acting in excellent confidence while supplying all appropriate facts and avoiding problems of interest.Not all relationships are effective ones. Possible downsides of dealing with an Economic Advisor consist of costs/fees, quality, and prospective desertion. Disadvantages: Costs/Fees This can easily be a favorable as high as it can be an adverse. The key is to ensure you obtain what your pay for. The stating, "rate is a problem in the absence of value" is exact.

Genuinely, the goal ought to be to seem like the recommendations and service obtained deserve greater than the expenses of the relationship. If this is not the situation, then it is an unfavorable and hence time to reevaluate the relationship. Disadvantages: Quality Not all Monetary Advisors are equal. Equally as, not one advisor is best for every prospective customer.

Everything about Clark Wealth Partners

A client should always be able to answer "what happens if something occurs to my Financial Consultant?". It begins with due persistance. Constantly properly veterinarian any type of Financial Advisor you are contemplating dealing with. Do not rely on ads, awards, credentials, and/or references solely when seeking a connection. These ways can be utilized to narrow down the swimming pool no question, yet then gloves need to be placed on for the remainder of the job.

when speaking with consultants. If a details location of experience is required, such as working with executive comp strategies or setting up retired life strategies for small business owners, find advisors to meeting that have experience in those sectors. When a connection begins, remain bought the partnership. Working with an Economic Expert should be a collaboration - financial advisors Ofallon illinois.

It is this kind of effort, both at the beginning and through the partnership, which will certainly assist accentuate the advantages and with any luck lessen the negative aspects. Do not hesitate to "swipe left" sometimes before you ultimately "swipe right" and make a solid link. There will be a cost. The duty of a Monetary Consultant is to aid customers establish a plan to meet the monetary objectives.

It is important to recognize all fees and the structure in which the advisor runs. The Financial Advisor is liable for supplying worth for the charges. https://peatix.com/us/user/28439859.

Clark Wealth Partners Fundamentals Explained

Preparation A company plan is important to the success of your business. You require it to know where you're going, just how you're arriving, and what to do if there are bumps in the roadway. An excellent economic consultant can put with each other a comprehensive strategy to aid you run your service more effectively and get ready for anomalies that occur.

Decreased Stress As a service proprietor, you have whole lots of points to worry about. An excellent monetary expert can bring you tranquility of mind recognizing that your funds are obtaining the interest they need and your money is being invested sensibly.

In some cases organization owners are so concentrated on the daily work that they shed view of the large photo, which is to make a revenue. A financial advisor will look at the general state of your finances without obtaining emotions included.

Clark Wealth Partners Fundamentals Explained

There are several benefits and drawbacks to consider when hiring an economic advisor. They can give important competence, particularly for complex monetary planning. Advisors offer customized approaches tailored to private objectives, possibly resulting in much better financial end results. They can likewise reduce the stress of handling investments and monetary decisions, providing tranquility of mind.

The cost of hiring a financial advisor can be considerable, with costs that might affect general returns. Financial planning can be frustrating. We advise talking with a monetary expert.

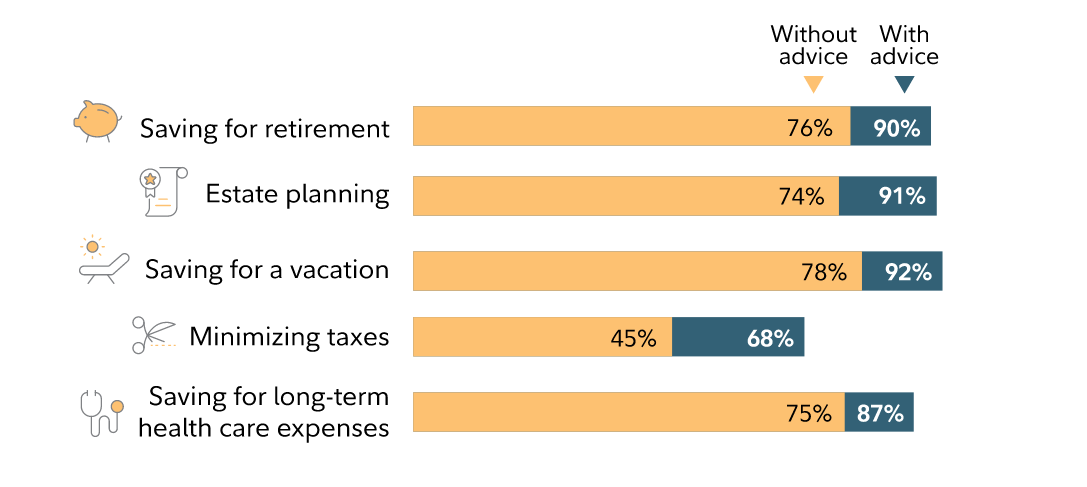

Discover Your Consultant People transform to economic consultants for a myriad of factors. The potential advantages of hiring a consultant include the proficiency and expertise they provide, the individualized advice they can offer and the lasting self-control they can inject.

Facts About Clark Wealth Partners Uncovered

Advisors learn specialists who stay updated on market trends, investment methods and financial laws. This knowledge allows them to give insights that may not be readily noticeable to the typical person - https://dev.to/clarkwealthpt. Their proficiency can aid you navigate complex economic circumstances, make informed decisions and potentially exceed what you would accomplish by yourself